Gold recovered some losses after weak U.S. retail sales data. Bullion prices rose back above the $2,000 an ounce level on Thursday after breaking well below the level earlier in the week. Some safe haven demand- following data showing recessions in Japan and the UK- also aided gold prices. But despite seeing some relief, the Gold was still set for steep weekly losses as traders largely scaled back expectations for early rate cuts, especially following hotter-than-expected consumer price index inflation data earlier this week.

Gold is waiting for economic data to take action.

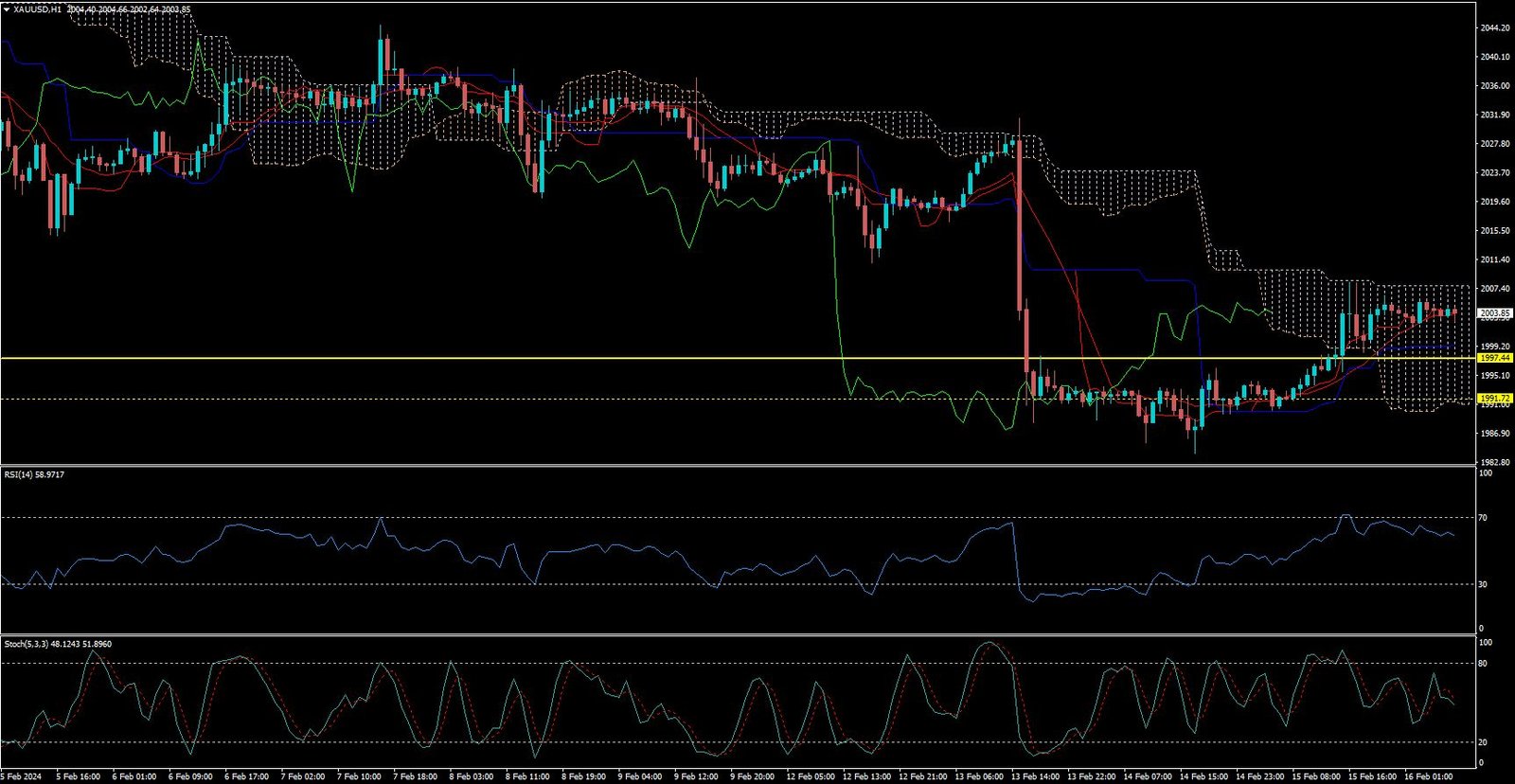

CURRENTLY GOLD IS MOVING ON UP TREND.

Expecting correction up to 1997.50

Today’s important levels for trading are 1993.34, 2000.76, 2011.37 and 2018

Trading idea for today: Buy on Dip

Trade setup:

Pullback Buy around@1997.50 Deeper Buy around@ 1991.50

Safe swing sell below 1987.50

Safe swing buy above 2013.50

Important Event :

🔴 Core PPI m/m

🔴 PPI m/m

🟠 Building Permits

🔴 Prelim UoM Consumer Sentiment

🟠Prelim UoM Inflation Expectations