Gold prices steadied in the Morning, sitting near record high as traders bought into the yellow metal ahead of more cues on U.S. inflation and interest rates. Among industrial metals, copper prices rebounded from recent losses, moving back towards 11-month peaks after reports showed that Chinese copper smelters were proposing output cuts. Bullion prices recovered a bulk of their losses this week as expectations that the Federal Reserve could cut interest rates by as soon as June remained in play. But strength in the dollar, which sat near a one-month high, kept gold prices just off record highs.

Spot gold steadied at $2,195.34 an ounce, while gold futures expiring in April steadied at $2,215.80 an ounce. Spot prices were just below a record high of $2,222.90 an ounce hit last week.

Today’s focus is on Final GDP q/q and Unemployment claims

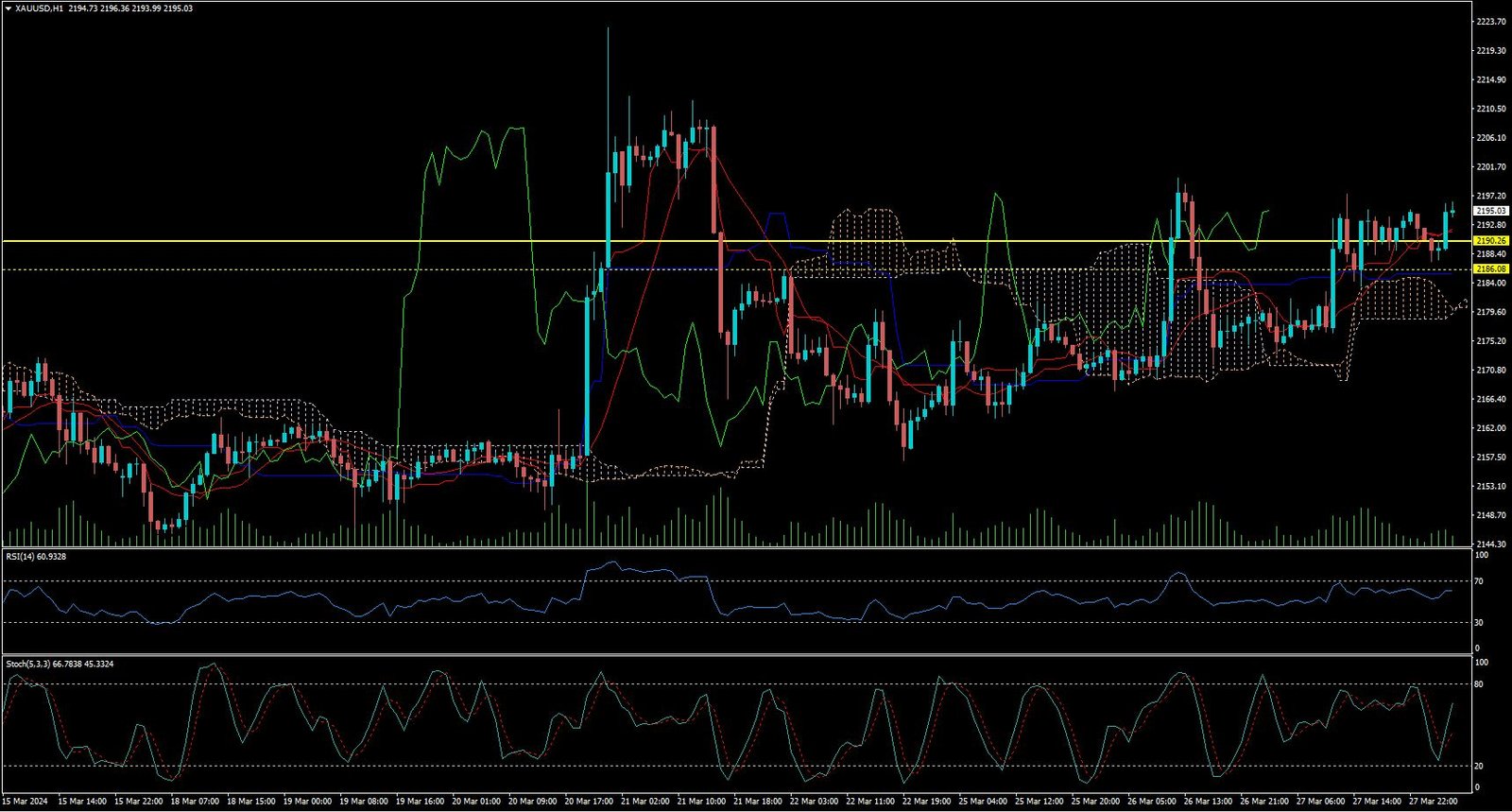

CURRENTLY GOLD IS MOVING ON UP TREND.

Expecting correction up to 2190.25

Today’s important levels for trading are 2197.43, 2188.50, 2200.03 and 2212.87

Trading Strategy for today: Buy On Dip

Trade setup:

Pullback Buy around 2190.50 Deeper Buy around 2186.50

Safe swing sell below 2177.50

Safe swing buy above 2197.50

🔴 Final GDP q/q

🔴 Unemployment Claims

🟠 Final GDP Price Index q/q

🟠 Chicago PMI

🔴 Pending Home Sales m/m

🔴 Revised UoM Consumer Sentiment

Remark: This market analysis is published to increase your awareness, but not to give instructions to make a trade.