Gold prices slipped in the morning, extending overnight losses as easing concerns over geopolitical tensions in the Middle East sapped the yellow metal of safe haven demand. This trade also left gold more vulnerable to recent strength in the dollar, while the prospect of higher-for-longer U.S. interest rates presented more price pressures for bullion. Growing hopes that the conflict between Iran and Israel will not escalate further saw traders begin to price out risk premiums from commodity prices. Gold had been a key beneficiary of increased safe haven demand over the past two weeks, after Iran and Israel both carried out strikes against each other. But after Israel’s latest attack on Iran, reports suggested that Tehran was not seeking immediate retaliation. This potential de-escalation sapped away at safe haven demand for gold. Easing safe haven demand also made gold more vulnerable to the higher-for-longer outlook on U.S. interest rates, especially after hawkish Federal Reserve signals and sticky inflation readings over the past two weeks. Higher rates bode poorly for gold, given that they increase the opportunity cost of investing in the Gold. Focus this week is on PCE price index data- the Fed’s preferred inflation gauge- for more cues on rates.

Spot gold slid 0.9% to $2,305.14 an ounce, while gold futures expiring in June fell 1.1% to $2,319.70 an ounce by 00:45 ET (04:45 GMT). Spot prices were now trading well below a record high of around $2,430 an ounce hit earlier in April.

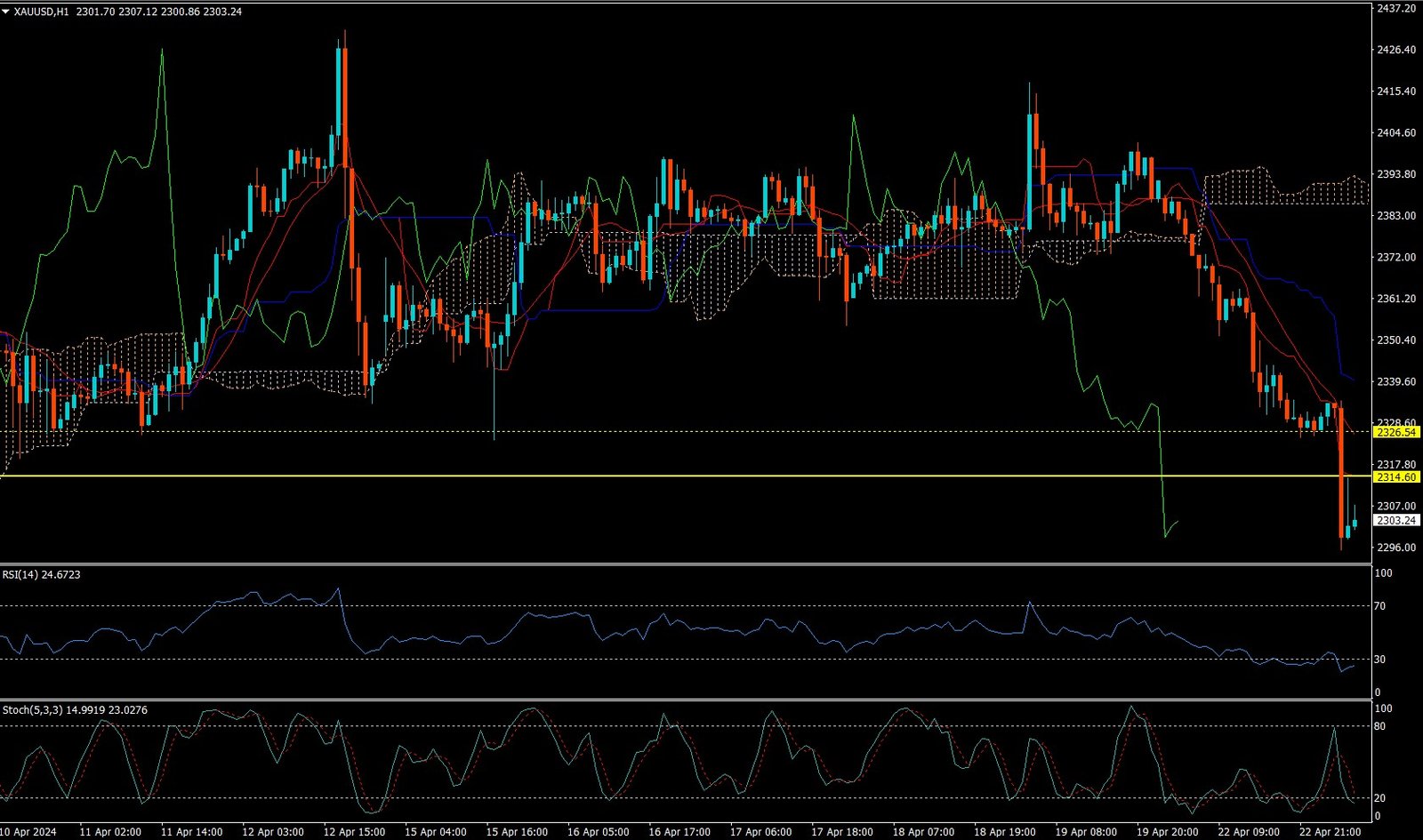

CURRENTLY GOLD IS MOVING ON DOWN TREND.

Expecting correction up to 2314.60

Today’s important levels for trading are 2368.40, 2346.67, 2305.10 and 2283.37

Trading Strategy for today: Sell on Rise

Trade setup:

Pullback Sell around 2313.50 Higher Sell around 2325.50

Safe swing sell below 2297.50

Safe swing buy above 2427.50

Important Event :

🔴 Flash Manufacturing PMI

🔴 Flash Services PMI

🟠 New Home Sales

🟠 Richmond Manufacturing Index