Gold prices moved little in morning, hovering well below recent record highs as investors remained largely biased towards the dollar before more cues on the Federal Reserve and inflation. The Gold saw limited safe haven demand amid some expectations of a Israel-Hamas ceasefire, especially as the U.S. now appeared to be making a greater effort to broker a deal. The Biden Administration reportedly suspended arms exports to Israel over its attacks on Rafah. But the biggest pressure on gold remained the prospect of high for longer U.S. interest rates, especially after several Fed officials warned of such a scenario. The yellow metal saw little love as a string of Fed officials warned that sticky inflation will deter any plans to cut rates in the near-term. While markets still held out hope for a September rate cut, focus was now on addressed from more Fed officials, due on Thursday and Friday. Beyond that, key consumer price index data for April is due next week, and is likely to offer up definitive signals on the path of interest rates. High for longer rates bode poorly for gold, given that they push up the opportunity cost of investing in the Gold.

Spot gold rose 0.2% to $2,313.51 an ounce, while gold futures expiring in June fell 0.1% to $2,320.60 an ounce.

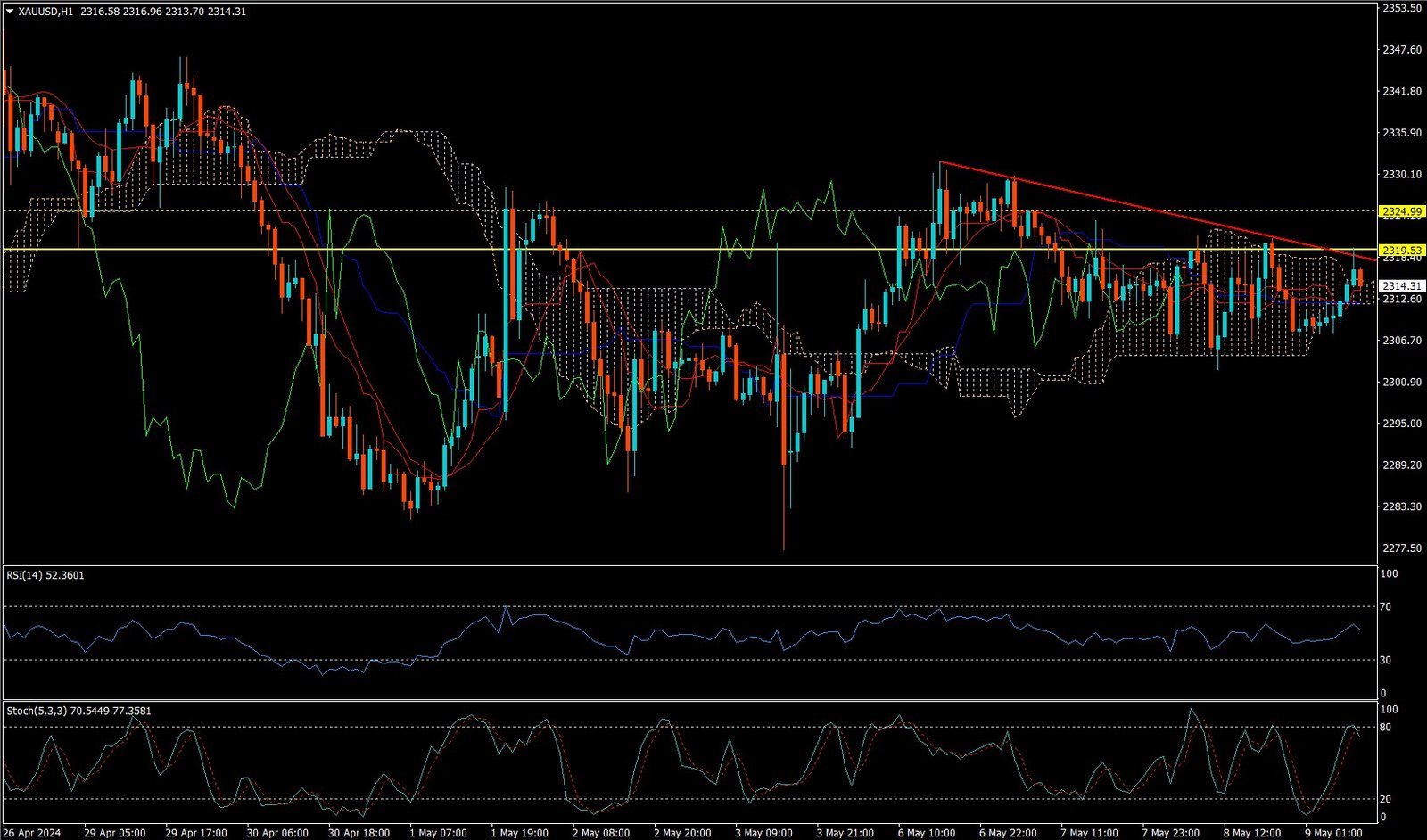

CURRENTLY GOLD IS MOVING ON DOWN TREND.

Expecting correction up to 2319.50

Today’s important levels for trading are 2318.94, 2310.75, 2300.14 and 2291.95

Trading Strategy for today: Sell on Rise

Trade setup:

Pullback Sell around 2319.50. Higher Sell around 2324.00

Safe swing sell below 2302.50

Safe swing buy above 2331.50

Important Event :

🔴Unemployment Claims

🔴30-y Bond Auction