Gold prices rose in Asian trade on Monday and were trading in sight of record highs as the yellow metal benefited from increased safe haven demand amid heightened concerns over slowing economic growth. A softer dollar also aided metal markets, as a swathe of weak U.S. economic readings saw traders pricing in greater reductions in U.S. interest rates this year. Gold has been the standout commodity performer so far this year, gaining 18.5% and posting a record high. But the precious metal may become a victim of its own success, with consumer buying at risk from the surge in prices. Spot gold ended at $2,443.29 an ounce on Aug. 2, and it has largely held onto the gains made this year, which saw a sustained rally to an all-time high of $2,483.60 on July 17. The World Gold Council released its quarterly report last week and the industry group reported total demand of 1,258.2 metric tons in the second quarter, the highest on record for a second quarter and some 4% above the same period in 2023.

Spot gold rose 0.4% to $2,453.51 an ounce, while gold futures expiring in December rose 1% to $2,495.40 an ounce

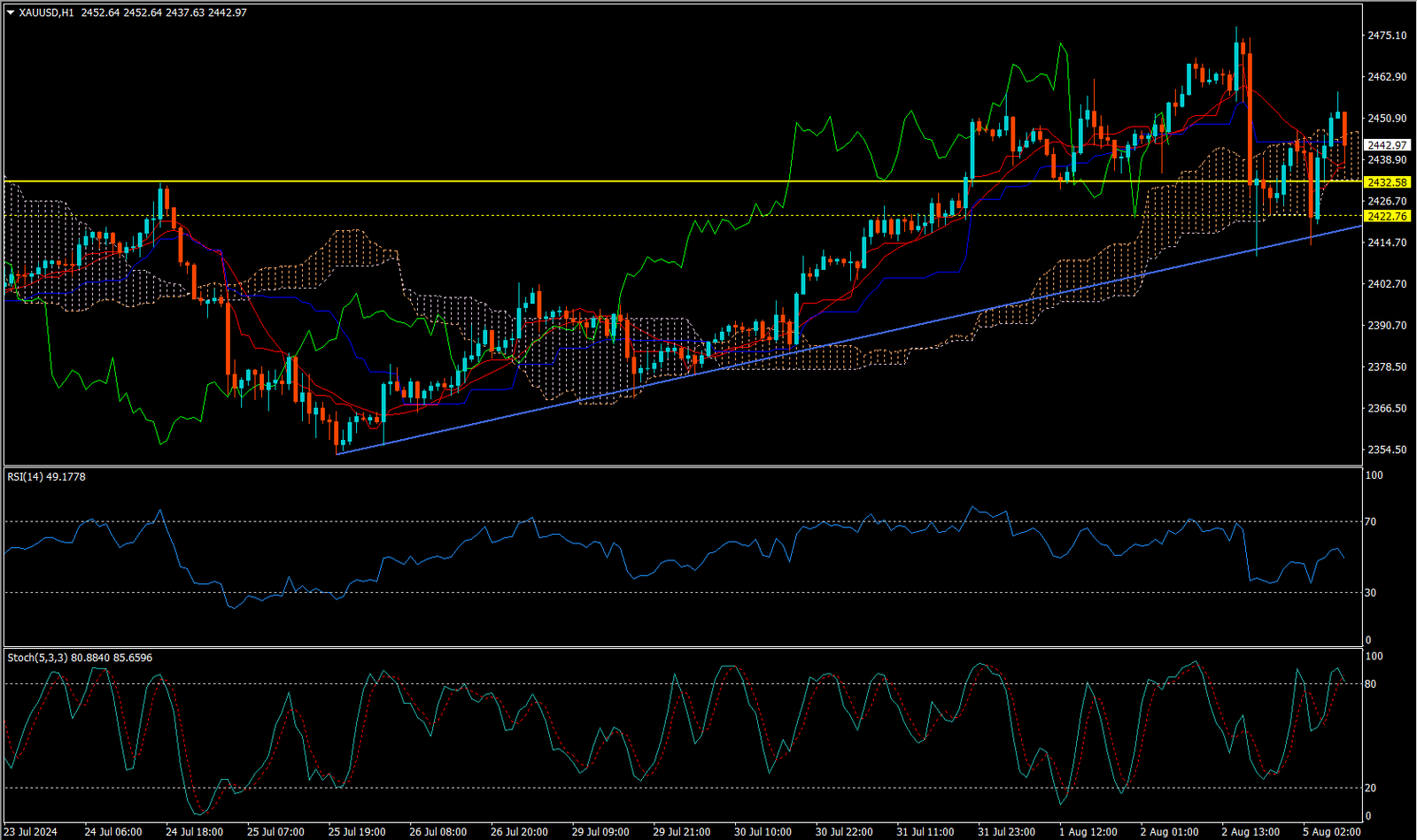

CURRENTLY GOLD IS MOVING ON DOWN TREND BUT OVERALL TREND IS UP

Expecting correction up to 2432.50

Today’s important levels for trading are 2409.41, 2443.49, 2476.25 and 2510.33

Trading Strategy for today: Buy on Dip

Trade setup:

Pullback Buy around 2432.50 Deeper Buy around 2422.50

Safe swing sell below 2417.50

Safe swing buy above 2457.50

Important Event :

🔴 Final Services PMI

🔴 ISM Services PMI