Gold prices steadied in the morning as traders awaited more cues on U.S. interest rates from a string of Federal Reserve speakers this week, while bets on a November cut persisted. It remained in sight of a September record high, as the prospect of an eventual decline in U.S. interest rates still buoyed precious metals. Persistent concerns over the Middle East conflict also kept safe haven demand in play.

Spot gold fell 0.1% to $2,655.82 an ounce, while gold futures expiring in December fell 0.1% to $2,672.60 an ounce Spot gold fell 0.1% to $2,655.82 an ounce, while gold futures expiring in December fell 0.1% to $2,672.60 an ounce

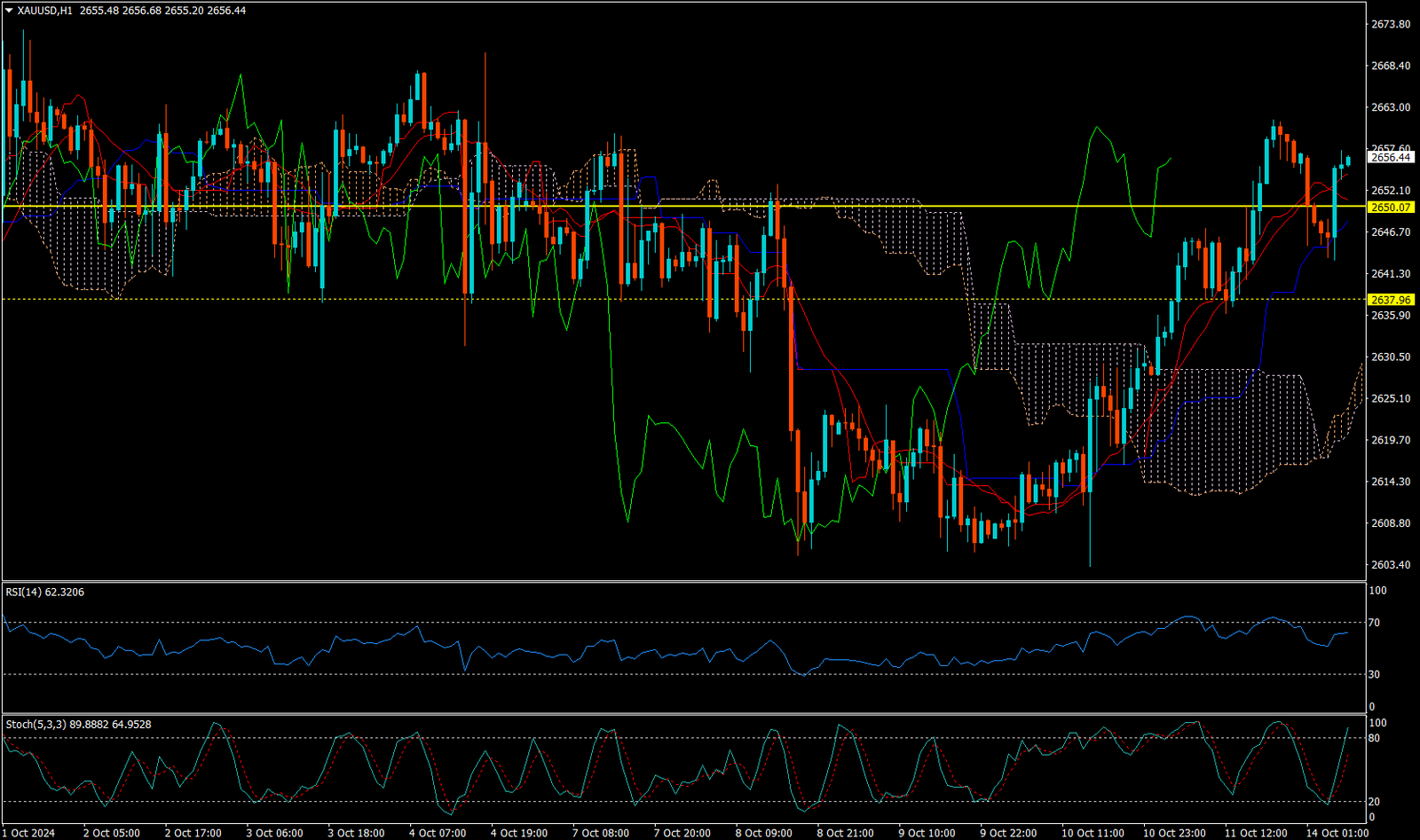

CURRENTLY GOLD IS MOVING ON UP TREND.

Expecting correction up to 2650.05

Today’s important levels for trading are 2636.20, 2648.77, 2669.51 and 2682.08

Trading Strategy for today: Buy On Dip

Trade setup:

Pullback Buy around 2650.50 Deeper Buy around 2638.50

Safe swing sell below 2633.50

Safe swing buy above 2667.50

Important Event :

🔴 FOMC Member Waller Speaks