Yesterday Gold moved mostly sideways in the range between 1995 to 1986, it is remaining below key support levels as the prospect of higher for longer U.S. interest rates continued to diminish the Gold’s appeal. It took some relief from mild losses in the dollar, which consolidated in overnight trade after racing to three-month highs earlier this week. The greenback is now likely to see more near-term gains, as traders began further scaling back expectations for early rate cuts by the Federal Reserve. A slew of Fed officials also warned that the central bank will keep rates higher if inflation remains sticky- a scenario that bodes poorly for gold. Higher rates push up the opportunity cost of investing in bullion.

Gold is waiting for U.S. retail sales, jobless claims data due later in the day is now in focus for more cues on the world’s largest economy. Producer price index inflation data for January, due on Friday, is also expected to provide more cues on the path of inflation. Several more Fed officials, including Christopher Waller and Mary Daly, are set to speak in the coming days, offering up more cues on monetary policy.

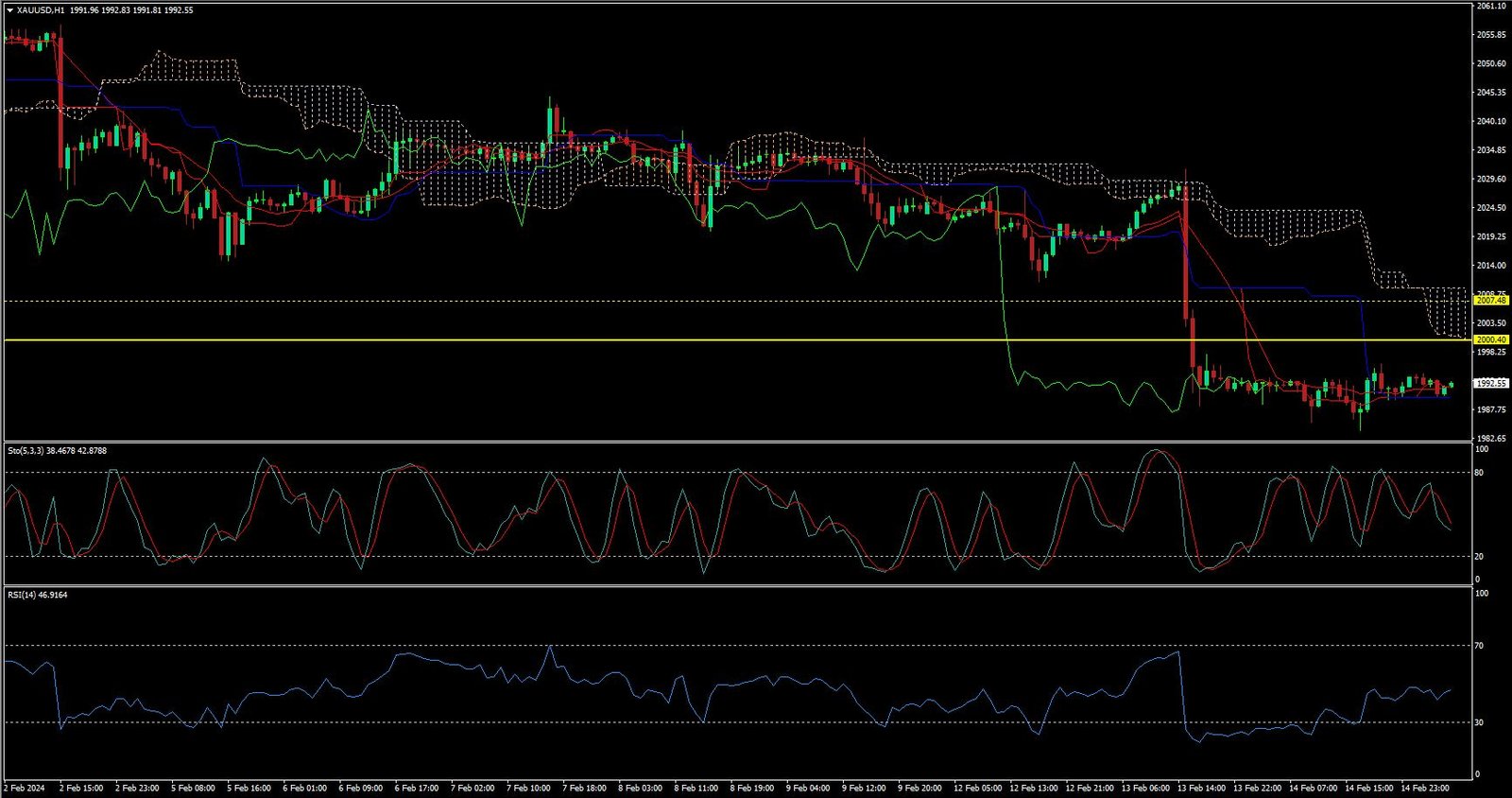

CURRENTLY GOLD IS MOVING ON DOWN TREND.

Expecting correction up to 2000.50

Today’s important levels for trading are 1997.31, 1990.69, 1985.36 AND 1978.74

Trading idea for today: Sell On Rise

Trade setup:

Pullback Sell around@1999.50 Higher Sell around@ 2007.50

Safe swing sell below 1987.50

Safe swing buy above 2013.50

Important Event : Core Retail Sales m/m, Empire State Manufacturing Index, Retail Sales m/m, Unemployment Claims, Industrial Production m/m and FOMC Member Waller Speaks