Crude oil rose on Today after hopes diminished that negotiations between Israel and Hamas would lead to a ceasefire in Gaza amid concerns the lingering conflict could potentially disrupt supply from the key Middle East producing region. A fresh round of Israel-Hamas ceasefire discussions in Cairo had ended a multi-session rally on Monday, leading Brent to its first decline in five sessions and WTI to its first in seven on the prospect that geopolitical risks could ease. But Israeli Prime Minister Benjamin Netanyahu said on Monday an unspecified date had been set for Israel’s invasion of the Rafah enclave in Gaza. That is “ending the hopes that briefly gripped the market yesterday that geopolitical tensions in the region might be easing,” Tony Sycamore, a market analyst with IG, wrote in a note. Hamas said early on Tuesday that Israel’s proposal it received from Qatari and Egyptian mediators did not meet any of the demands of Palestinian factions. But Hamas said it would study the proposal before responding to the mediators. Without an end to the conflict, there is an elevated risk that it involves other countries in the region, especially Iran, a major Hamas backer and the third-largest producer in the Organization of the Petroleum Exporting Countries (OPEC).

Brent crude futures rose 14 cents to $90.52 a barrel by 0610 GMT. U.S. West Texas Intermediate (WTI) crude was 10 cents higher at $86.53.

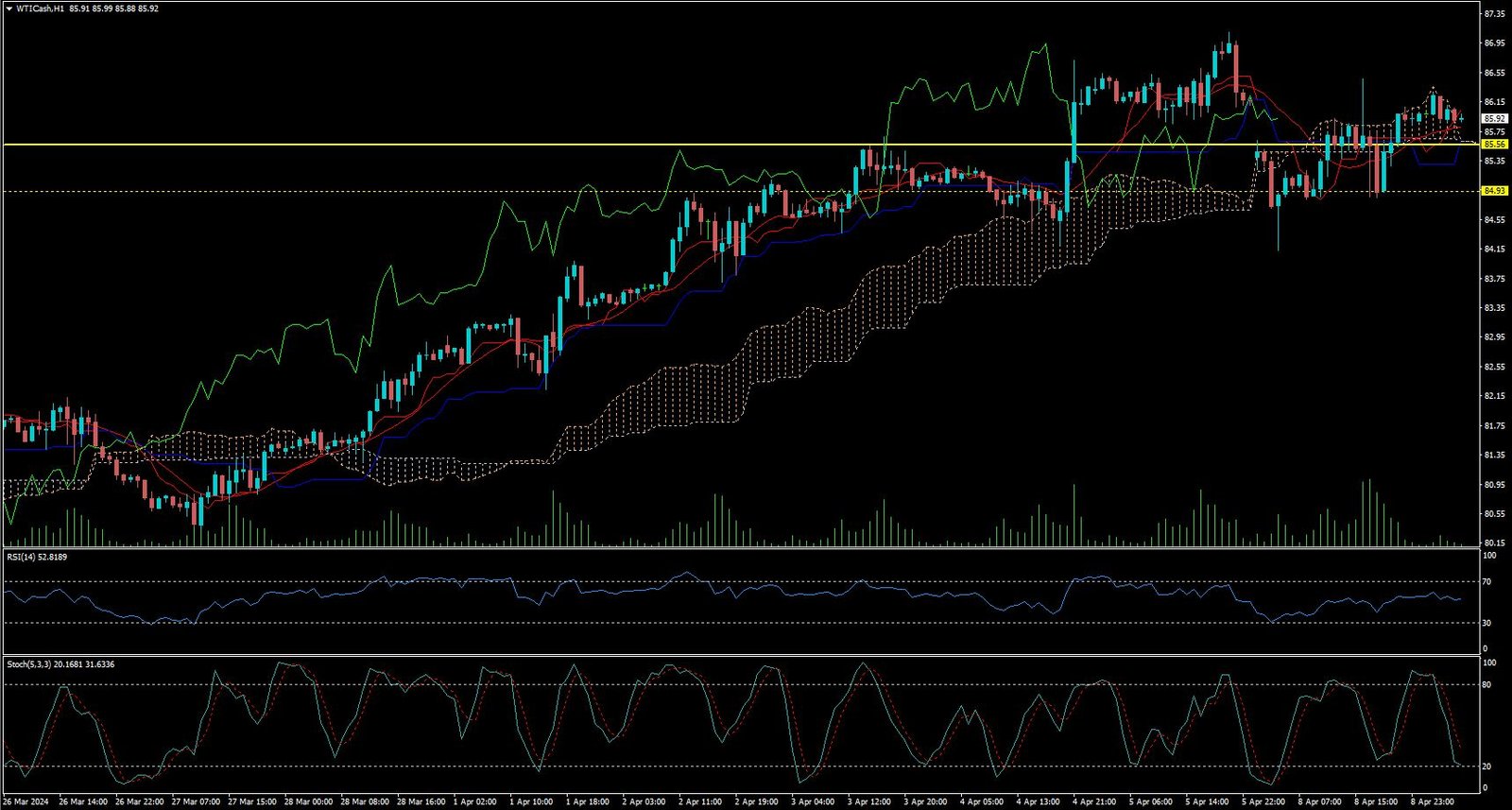

CRUDE OIL CURRENTLY MOVING ON UP TREND

Expecting correction up to 85.56

Today’s important levels for trading 84.55, 85.51, 86.89 and 87.85

Trading Strategy for today: Buy On Dip

Trade setup:

Pullback Buy around@85.60, Deeper Buy around@84.95

Safe swing sell below 84.15,

Safe swing buy above 86.75