Gold prices was below the record highs in the morning, as safe haven demand for the yellow metal was boosted in anticipation of key U.S. inflation data and more cues on interest rates. Among industrial metals, copper prices hit 15-month peaks amid growing hopes that demand will pick up tracking a recovery in global factory activity. Expectations of tighter copper supplies also remained in play. Gold was boosted chiefly by increased safe haven demand, while reports of central bank buying, particularly in China, also spurred increased demand for the yellow metal. This helped gold rise despite persistent concerns over higher-for-longer U.S. interest rates. Bigger gains in the Gold were held back chiefly by anticipation of key U.S. consumer price index data, which is due later on Wednesday. The data is expected to show that inflation remained sticky in March- a trend that gives the Federal Reserve less impetus to begin cutting interest rates. The CPI reading also comes after a bumper nonfarm payrolls report, as well as a slew of warnings from Fed officials that sticky inflation will delay any potential rate cuts by the central bank. The minutes of the Fed’s March meeting are also due later on Wednesday. While the prospect of higher-for-longer interest rates bodes poorly for gold, the yellow metal was supported increased central bank buying, especially in Asia and emerging markets. Gold demand was boosted by growing fears of a marked economic slowdown later this year.

Spot gold rose 0.3% to $2,359.28 an ounce, while gold futures expiring in June rose 0.6% to a record high of $2,377.45 an ounce by 01:34 ET (05:34 GMT). Spot prices hit a record high of $2,365.34 an ounce

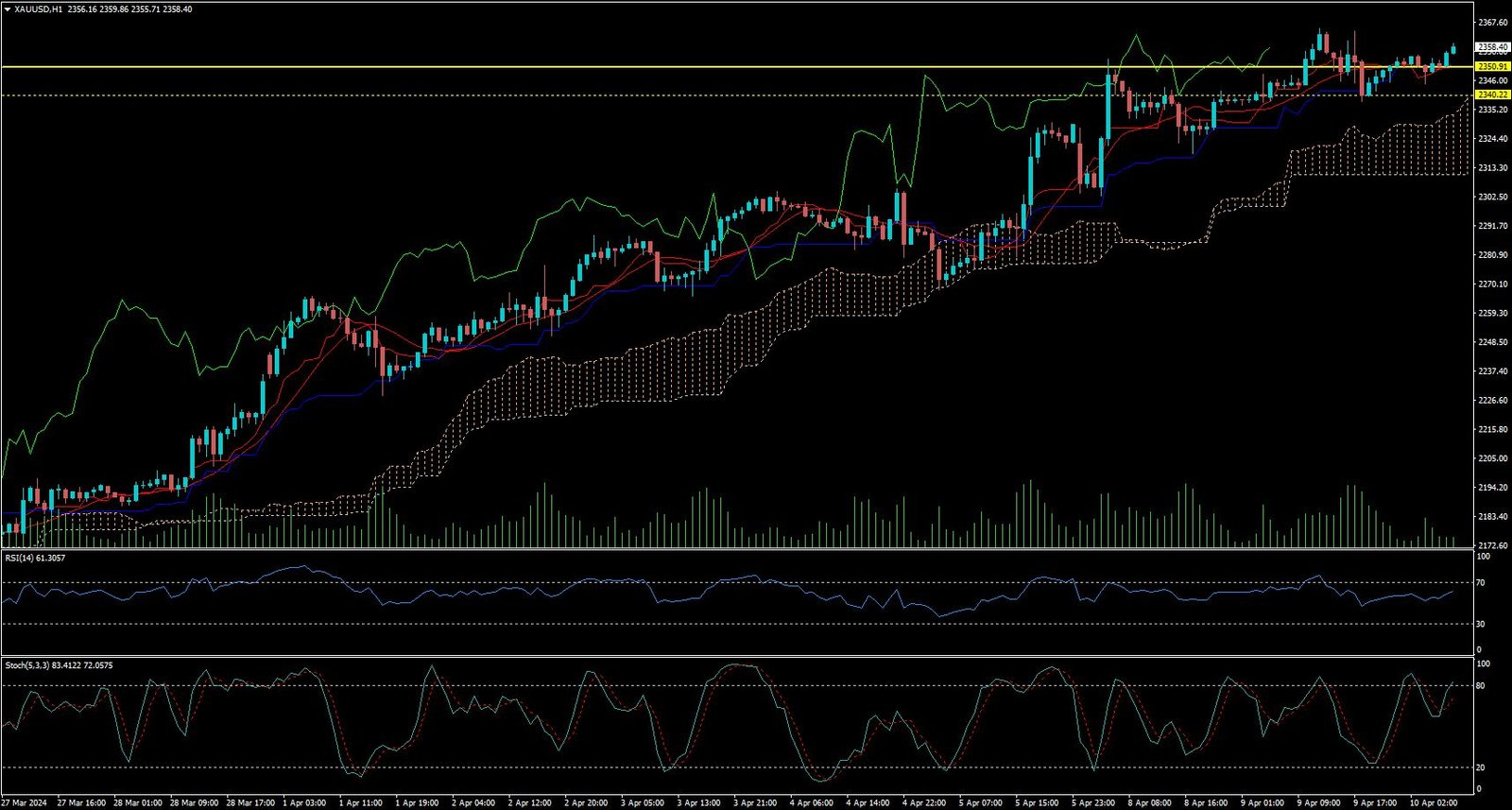

CURRENTLY GOLD IS MOVING ON UP TREND.

Expecting correction up to 2350.90

Today’s important levels for trading are 2337.91, 2351.57, 2366.38 and 2380.04

Trading Strategy for today: Buy on Dip

Trade setup:

Pullback Buy around 2351 Deeper Buy around 2340.50

Safe swing sell below 2317.50

Safe swing buy above 2367.50

Important Event :

🔴 Core CPI m/m,

🔴 CPI m/m,

🔴 CPI y/y,

🟠 FOMC Member Barkin Speaks,

🟠 10-y Bond Auction

🔴 FOMC Meeting Minutes