Gold prices fell slightly in the morning, remaining in a tight trading range as anticipation of a slew of cues on U.S. interest rates kept traders largely averse towards metal markets. Gold was nursing a fall through June, as fears of high U.S. interest rates pushed up the dollar and Treasury yields. Gold also remained stuck around $2,300 an ounce. Gold remained rangebound with focus largely on a slew of cues on interest rates due this week. Federal Reserve Chair Jerome Powell is set to speak at a European Central Bank conference later on Tuesday, although the Fed Chair is unlikely to provide any new cues on interest rates. But beyond Powell, the minutes of the Fed’s June meeting are due on Wednesday, coming after the central bank largely downplayed expectations for rate cuts during the meeting. Nonfarm payrolls data is due on Friday, and is set to offer more cues on the labor market, which has been largely running strong in recent months. The sector is also a key consideration for the Fed in cutting rates.

Spot gold fell 0.2% to $2,326.47 an ounce, while gold futures expiring in August fell 0.1% to $2,335.80 an ounce

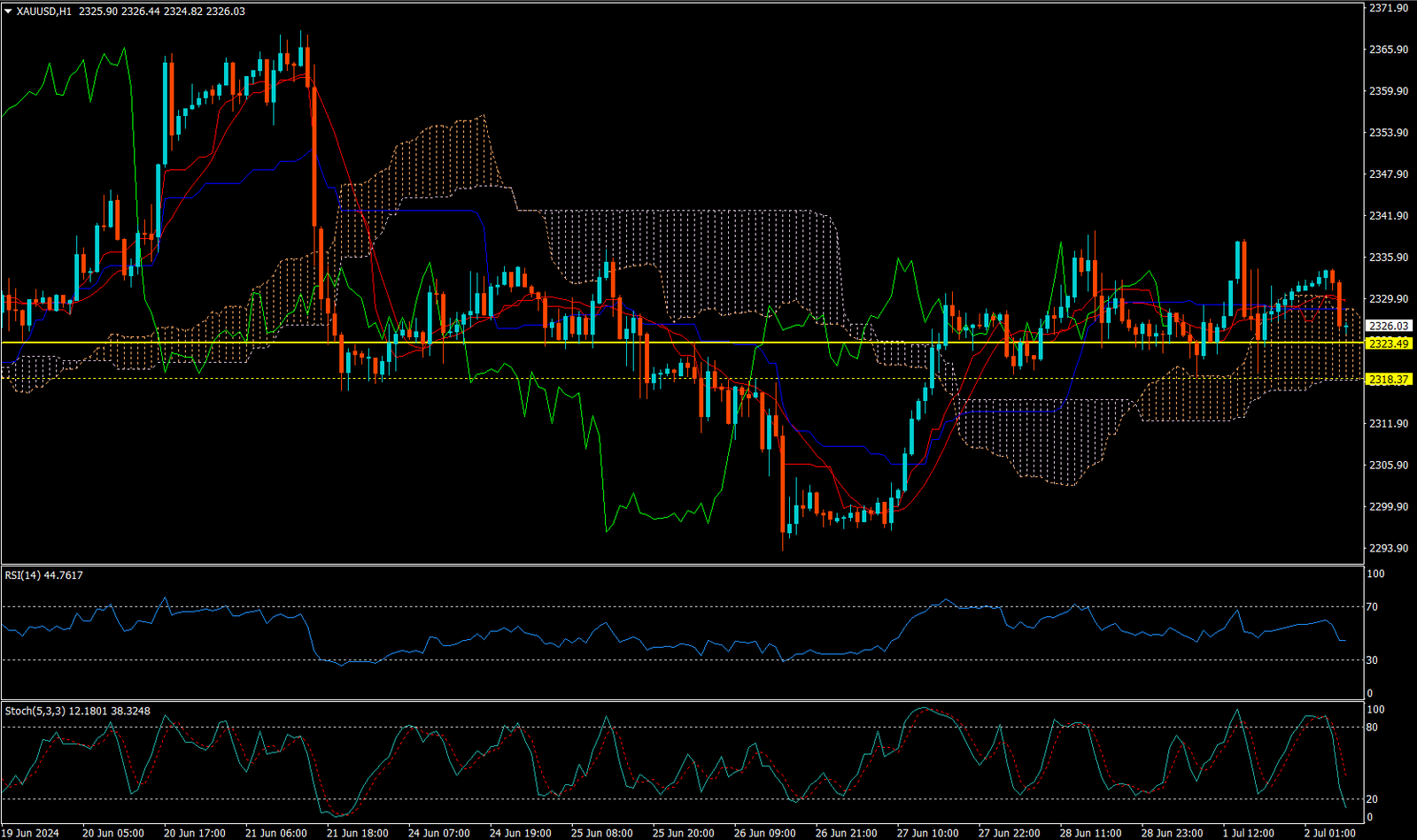

CURRENTLY GOLD IS MOVING ON UP TREND.

Expecting correction up to 2323.50

Today’s important levels for trading are 2320.66, 2329.55, 2340.68 and 2349.57

Trading Strategy for today: Buy On Dip

Trade setup:

Pullback Buy around 2323.50 Deeper Buy around 2318.50

Safe swing sell below 2317.50

Safe swing buy above 2343.50

Important Event :

🔴 Fed Chair Powell Speaks

🔴 JOLTS Job Openings