Gold prices rose in the morning , seeing some relief as the dollar retreated on some positive comments from Federal Reserve Chair Jerome Powell. But the yellow metal still remained within a trading range established through most of June, as anticipation of more cues on U.S. interest rates kept traders biased towards the dollar. Strength in gold came tracking an overnight decline in the dollar, after the Fed’s Powell flagged progress towards bringing down inflation. But Powell also warned that the central bank still needed more confidence to begin trimming interest rates. This notion, coupled with anticipation of more key cues on the U.S. economy, kept gains in gold and other metals limited. Focus is now on the minutes of the Fed’s June meeting, due later on Wednesday, as well as addresses by other Fed officials in the coming days. More closely watched will be nonfarm payrolls data due this Friday, which is set to offer definitive cues on the labor market.

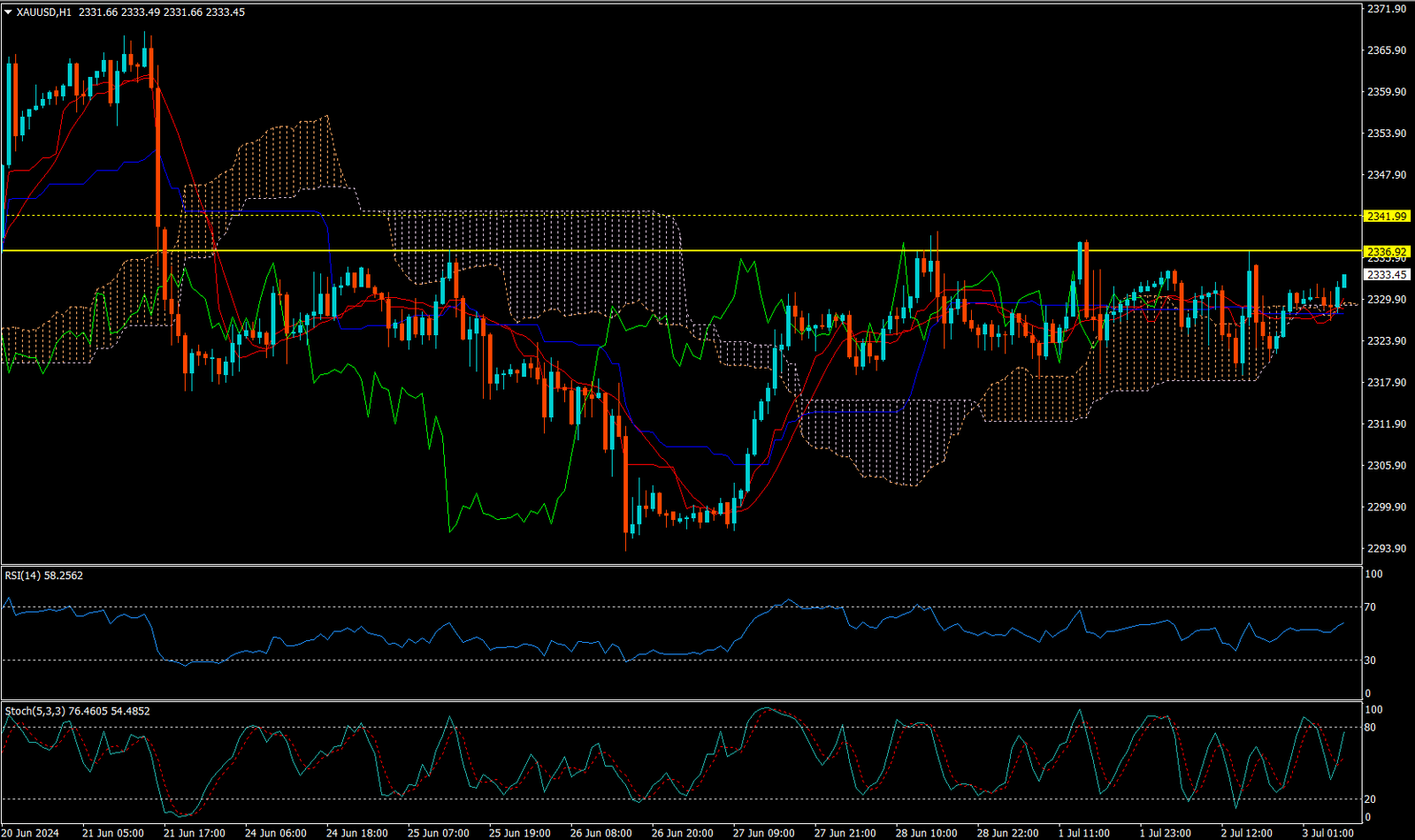

Spot gold rose 0.1% to $2,332.16 an ounce, while gold futures expiring in August rose 0.3% to $2,341.25 an ounce

CURRENTLY GOLD IS MOVING ON DOWN TREND.

Expecting correction up to 2336.90

Today’s important levels for trading are 2337.73, 2328.37, 2320.01 and 2310.65

Trading Strategy for today: Sell On Rise

Trade setup:

Pullback Sell around 2336.50 Higher Sell around 2341.50

Safe swing sell below 2317.50

Safe swing buy above 2343.50

Important Event :

🔴ADP Non-Farm Employment Change,

🔴Unemployment Claims,

🟠Final Services PMI,

🔴ISM Services PMI,

🔴FOMC Meeting Minutes