Gold prices slipped in the morning but It steadied at a 10-day high after growing bets on interest rate cuts by the Federal Reserve pulled down the dollar and Treasury yields. But gold’s advance was stalled by hawkish signals from the minutes of the Fed’s June meeting, while anticipation of key nonfarm payrolls data kept traders cautious. Gold marked strong gains on Wednesday, tracking a sharp fall in the dollar as traders upped their bets for a rate cut in September. The trend came following weaker-than-expected ADP employment data and a soft reading on non-manufacturing activity, which pushed up bets that the U.S. economy was cooling. The CME Fedwatch tool showed traders pricing in an over 68% chance for a 25 basis point cut in September, up from a 59% chance seen a day ago. Lower rates bode well for non-yielding assets such as gold, given that they diminish the appeal of Treasuries and the dollar.

Spot gold rose 0.1% to $2,359.56 an ounce, while gold futures expiring in August fell 0.1% to $2,367.15 an ounce

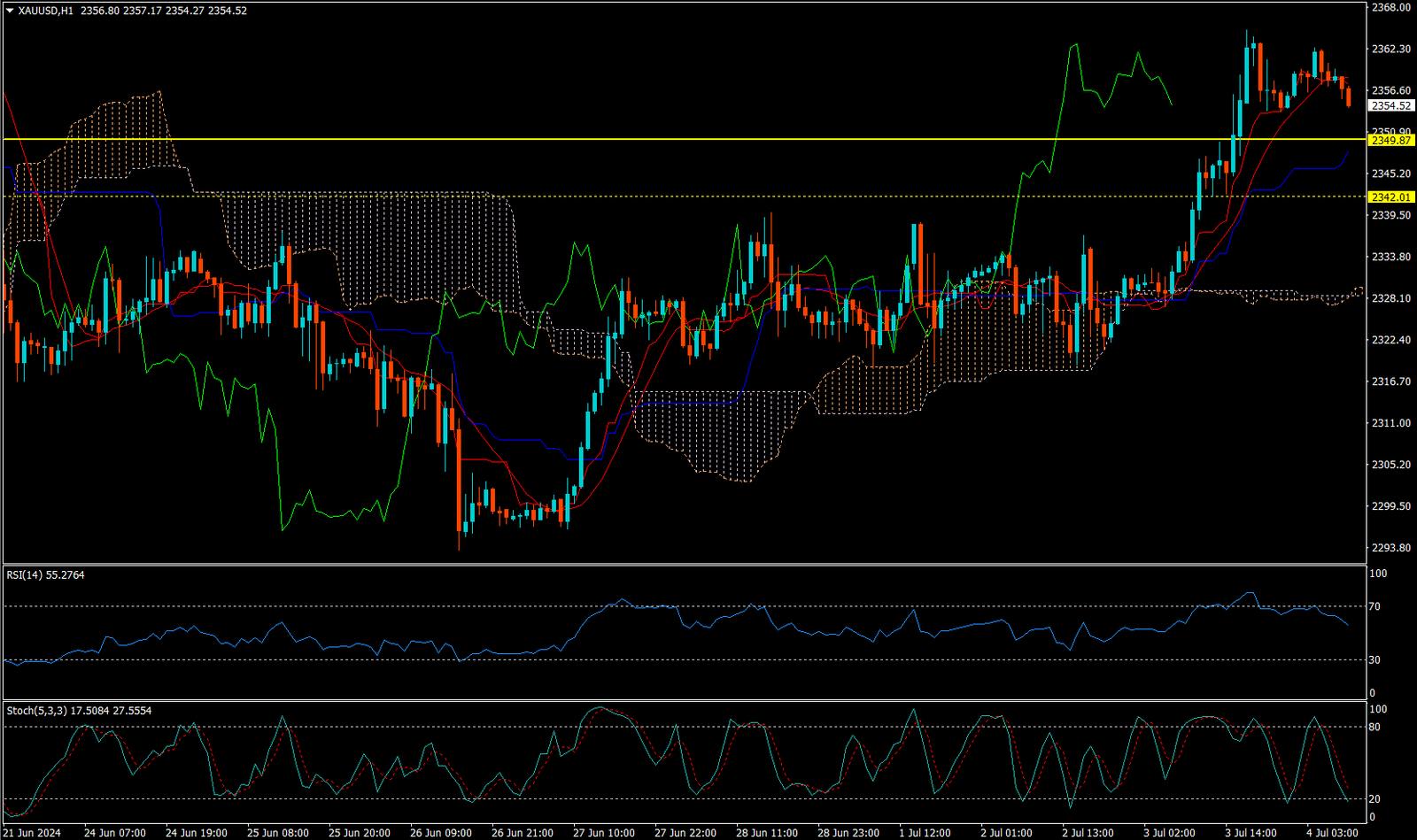

CURRENTLY GOLD IS MOVING ON UP TREND.

Expecting correction up to 2349.80

Today’s important levels for trading are 2333.48, 2349.18, 2371.52 and 2387.22

Trading Strategy for today: Buy On Dip

Trade setup:

Pullback Buy around 2350.50 Deeper Buy around 2342.50

Safe swing sell below 2337.50

Safe swing buy above 2363.50

Important Event :

⚪ US Bank Holiday