Gold prices fell slightly in the morning as traders awaited more cues on U.S. interest rates from a testimony by Federal Reserve Chair Jerome Powell and key inflation data due through the week. But bullion prices were sitting close to one-month highs, and were also on the cusp of breaking back above $2,400 an ounce amid growing conviction that the Fed will begin cutting interest rates in September. Broader metal prices also benefited from a drop in the dollar, which hit a near one-month low. Gold rose sharply through the past week, breaking out of the low-$2,300s as a slew of weak readings on the labor market brewed more optimism over interest rate cuts. Soft nonfarm payrolls data on Friday was a key driver of gold’s gains. Gold stands to benefit from lower rates, which are expected to free up more liquidity and also diminish the appeal of the dollar and Treasuries. The CME Fedwatch tool showed traders pricing in an over 72% chance the Fed will cut rates by 25 basis points in September, up from 59% seen last week. Focus this week is on more cues on the U.S. economy and monetary policy. Powell is set to offer a two-day testimony before the Senate and the House, potentially shedding more light on the Fed’s plans for interest rates.

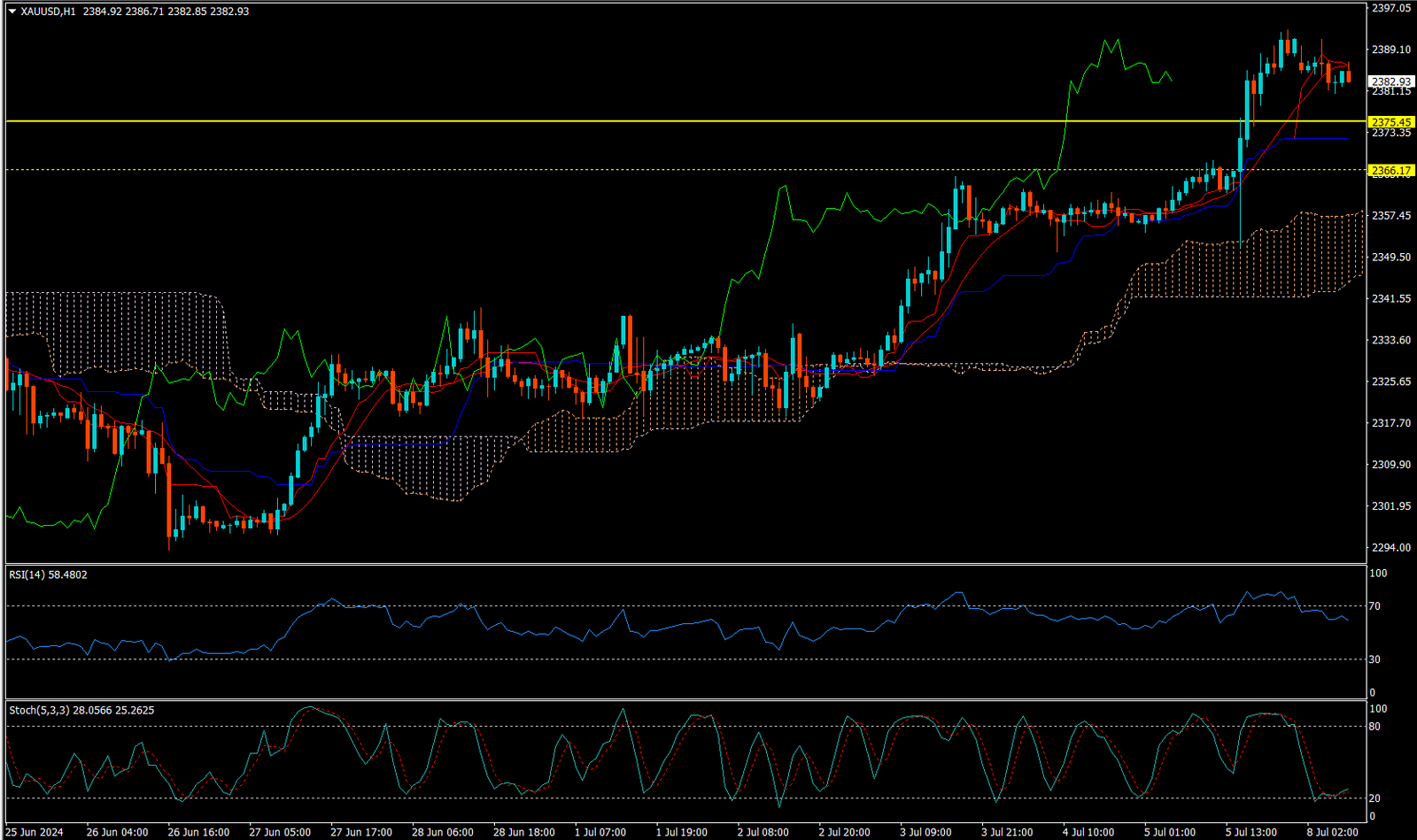

CURRENTLY GOLD IS MOVING ON UP TREND.

Expecting correction up to 2375.45

Today’s important levels for trading are 2364.17, 2378.49, 2405.47 and 2419.79

Trading Strategy for today: Buy On Dip

Trade setup:

Pullback Buy around 2376.50 Deeper Buy around 2366.50

Safe swing sell below 2363.50

Safe swing buy above 2393.50

Important Event :

No Important Events