Oil prices steadied in the morning after rebounding in the prior session amid some bargain buying, but were still headed for steep weekly losses amid persistent concerns over slowing demand. Continued negotiations over an Israel-Hamas ceasefire also saw traders attach a smaller risk premium to crude, with U.S. officials stating that an agreement was close. But Hamas had recently criticized a ceasefire proposal brokered by the U.S. for favoring Israel.

Brent oil futures expiring in October rose 0.1% to $77.26 a barrel, while West Texas Intermediate crude futures rose 0.1% to $72.34 a barrel

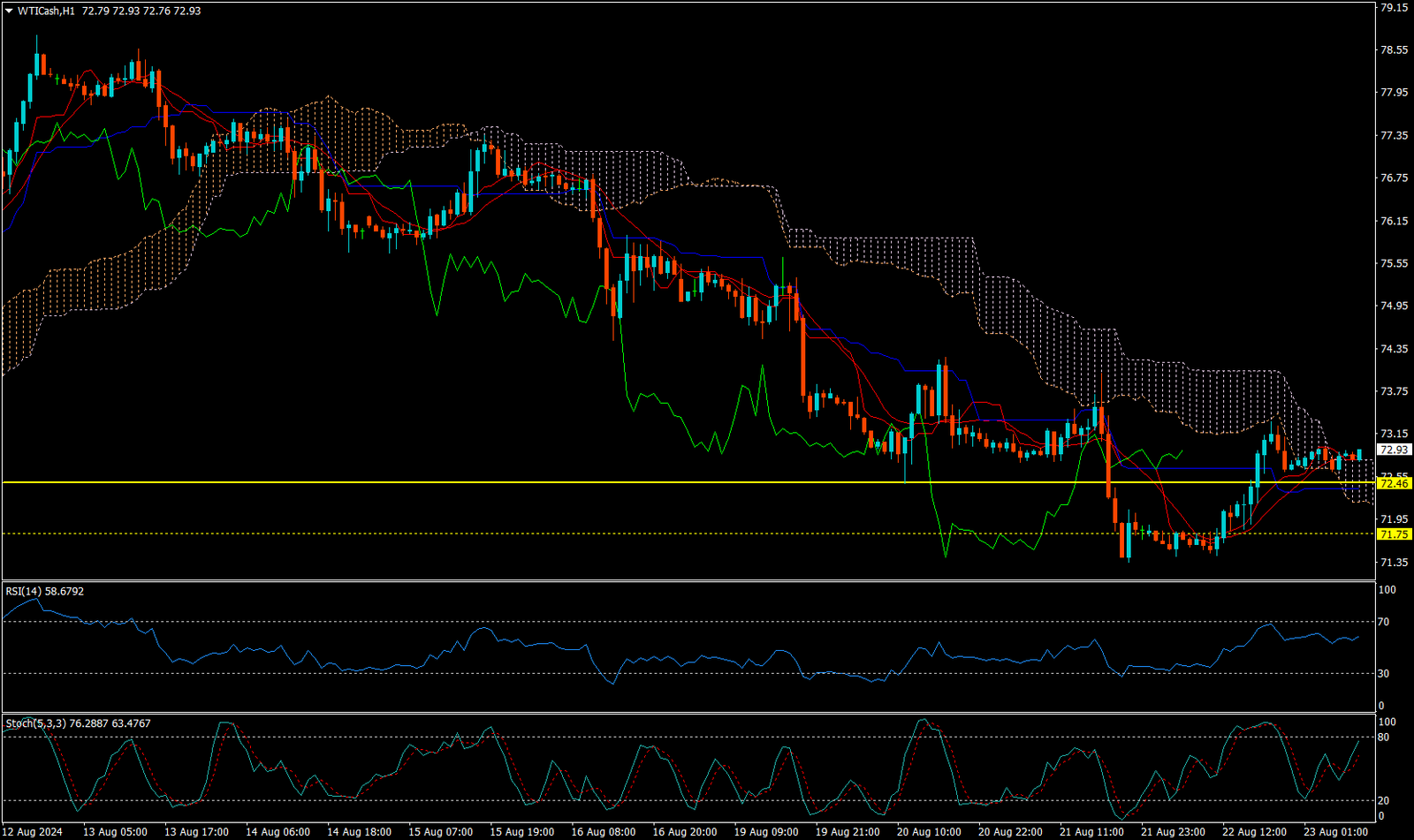

CURRENTLY CRUDE OIL IS MOVING ON UP TREND.

Expecting correction up to 72.46

Today’s important levels for trading are 71.69, 72.51, 73.58 and 74.40

Trading Strategy for today: Buy On Dip

Trade setup:

Pullback Buy around 72.50 Deeper Sell around 71.75

Safe swing sell below 71.30

Safe swing buy above 73.75