Gold prices rose in the morning, remaining in sight of record highs as anticipation of a tight presidential election and an upcoming Federal Reserve meeting kept haven demand high. Gold was also buoyed by weakness in the dollar after substantially softer-than-expected nonfarm payrolls data last week, which furthered the case for more interest rate cuts by the Fed. In addition to pre-election haven demand, gold also took support from recent declines in the dollar, as the greenback tumbled from three-month highs after soft payrolls data released last week. The reading showed the U.S. job market barely grew in October, with downward revisions for the past two months pointing to a cooling in the labor sector.

Spot gold rose 0.2% to $2,741.31 an ounce, while gold futures expiring in December steadied at $2,750.40 an ounce.

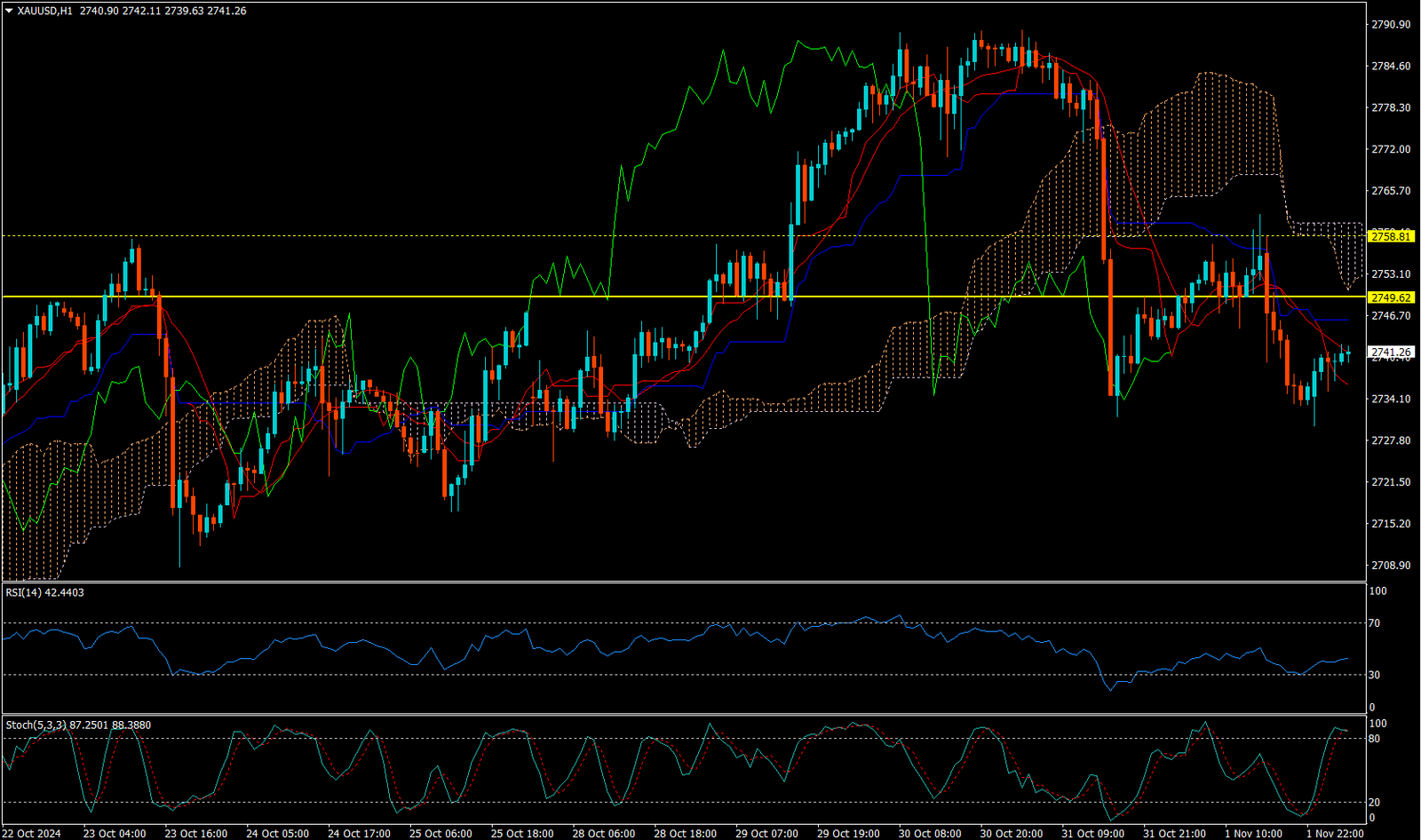

CURRENTLY GOLD IS MOVING ON DOWN TREND.

Expecting correction up to 2749.60

Today’s important levels for trading are 2754.32, 2743.71, 2725.31 and 2714.70

Trading Strategy for today: Buy On Dip

Trade setup:

Pullback Sell around 2749.50 Higher Sell around 2758.50

Safe swing sell below 2763.50

Safe swing buy above 2733.50

Important Event : No Data