Gold prices rose to a more than four-month high in Asian trading on Monday, lifted by hopes for a Federal Reserve rate cut this month, while Fed independence and U.S. tariff worries boosted bullion’s safe-haven demand. Investors increased wagers on a rate cut in September after the latest U.S. personal consumption expenditures price index came in largely in line with estimates. According to the CME FedWatch tool, markets are pricing in close to a 90% chance of a 25 basis point cut this month. Lower borrowing costs reduce the opportunity cost of holding non-yielding assets such as gold, making it attractive. Attention is now turning to U.S. jobs data due later this week. A weak non-farm payrolls report could strengthen the case for near-term easing, while a stronger reading may force investors to scale back expectations. Safe-haven flows into gold were also supported by trade policy uncertainty.

Spot Gold rose 0.9% to $3,480.56 an ounce, their highest level since mid-April. Gold Futures for December jumped 1% to $3,551.82/oz by 01:55 ET (05:55 GMT).

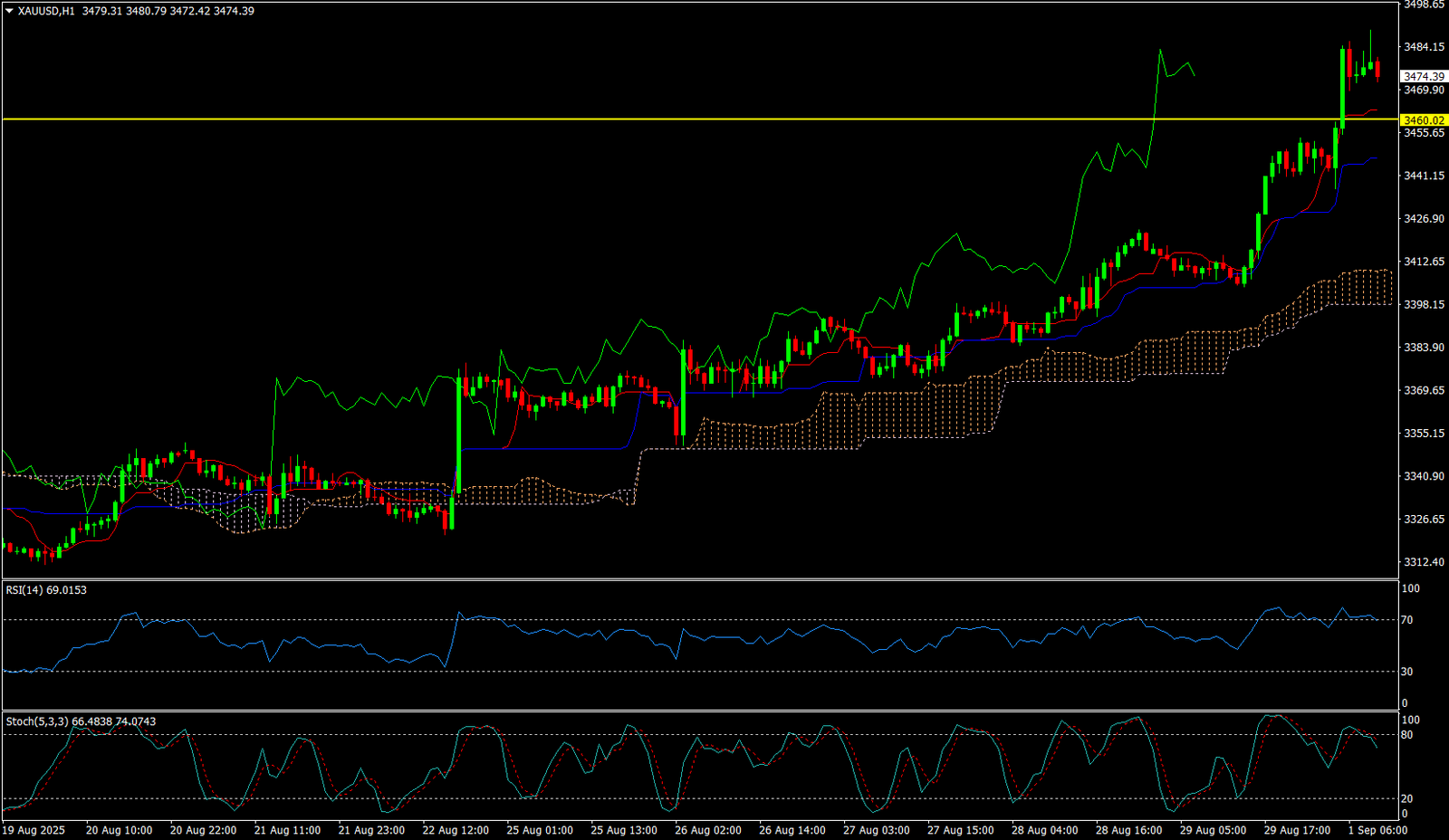

CURRENTLY GOLD IS MOVING ON UP TREND.

Expecting correction up to 3460.02

Today’s important levels for trading are 3515.92, 3484.86, 3466.34, 3435.28, 3416.76, 3385.7 and 3367.18

Trading Strategy for today: Buy On Dip

Trade setup:

Pullback Buy around 3460.50 Deeper Buy around 3450.50

Safe swing sell below 3437.50

Safe swing buy above 3485.50